Small business loans

Looking for a small business loan that’s right for your business?

Prospa is the small business loans specialist

With a team of small business loans specialists available at Prospa via phone, email, or web chat – you will feel supported and informed. Plus the award-winning Prospa Blog offers a fantastic resource hub full of helpful tips and insights, and a range of small business loans success stories to inspire you.

With a Prospa small business loan on your side you’ll be supported by funds up front so you can focus on growing your business or getting things back on track.

Customers love Prospa small business loans

Prospa small business loans are a great option for business growth and opportunities. In fact, recent research found that 82% of customers said their most recent Prospa small business loan resulted in an increase in revenue. And that’s what we like to hear!

Did you know that 69% of our customers come back for another loan*, and many keep coming back. In fact, we’ve been able to support these businesses with over $2 billion in funding so far. Best of all, our customers rate us #1 on Trustpilot.

Customers making it happen with a Prospa loan

Read customer stories

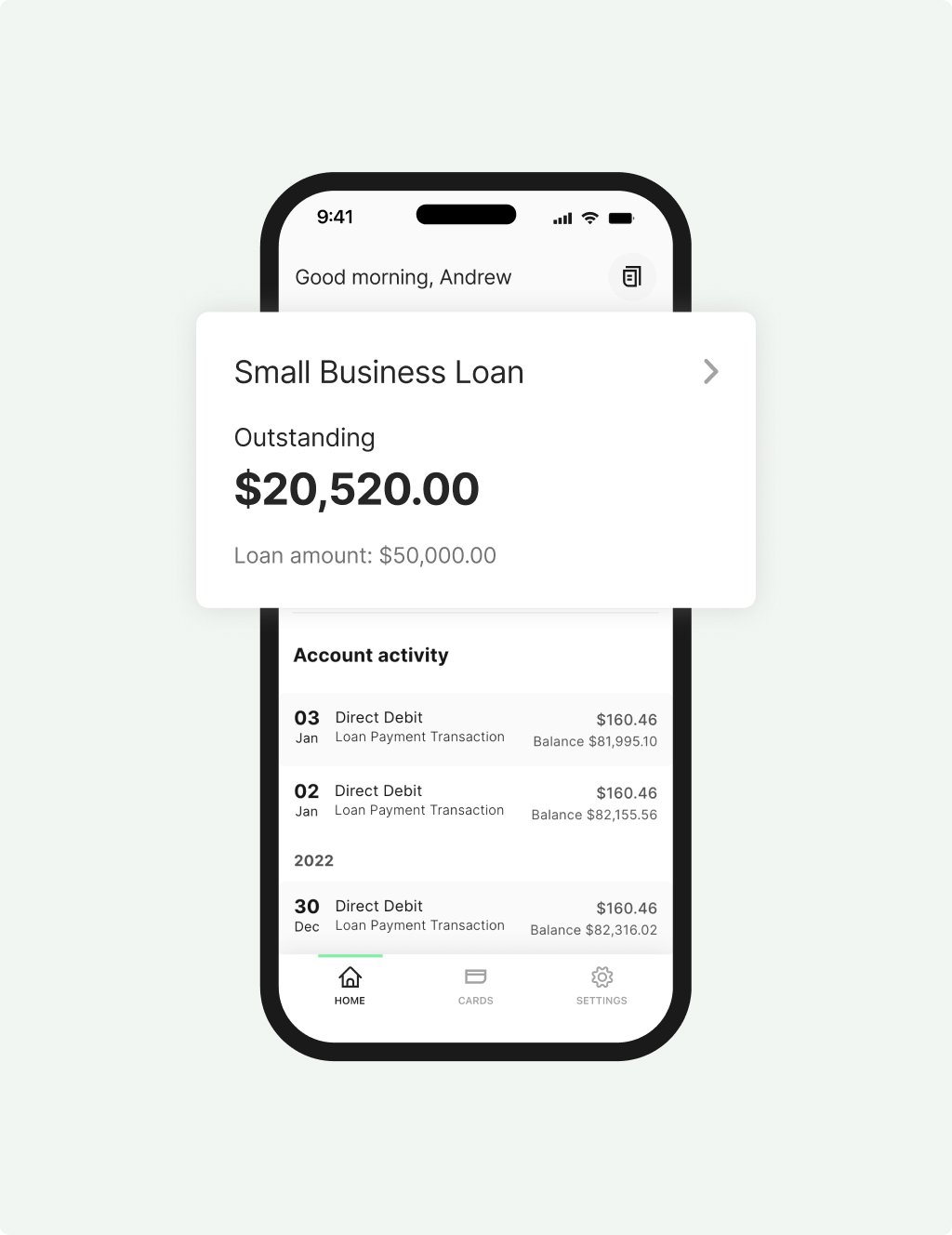

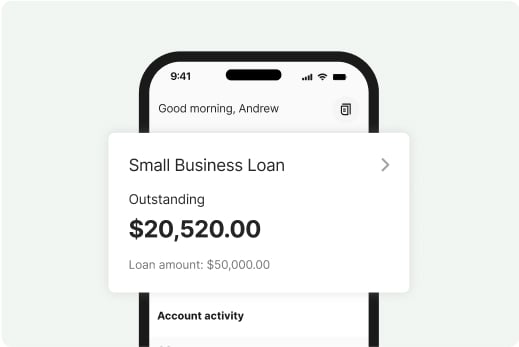

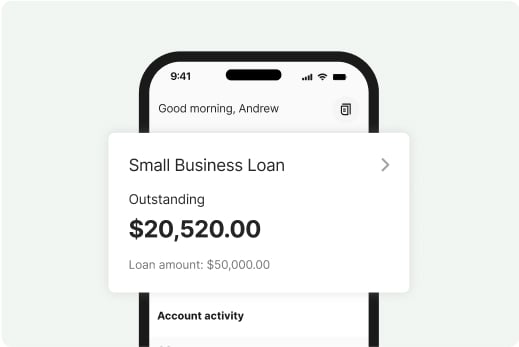

Small business loan features

- A lump sum between $5,000 and $300,000

- No asset security required upfront to access up to $150,000 of Prospa funding

- Fixed loan term from 3 to 36 months

- Easy application process with funding possible in 24 hours

- Interest rate based on your business circumstances

- Fixed daily or weekly repayments

Prospa small business loans

- Buy new equipment / upgrade old machinery

- Grow or expand your business by adding a new product or service

- Upgrade your IT infrastructure

- Renovate your office or retail store

- Run monthly ad campaigns to boost business

- Build your website or get it a facelift

What’s necessary to qualify for a small business loan

- Be an Australian Citizen (or permanent resident)

- Be over the age of 18 years

- Own an Australian business with a valid ABN/ACN

- Demonstrate 6 months of trading for a new business (or three months if you have purchased an existing business)

What you need to apply for a small business loan

FAQs

Frequently asked questions

At Prospa, we know that when you need finance, you are probably keen to get the funds as quickly as possible – that way you don’t miss an opportunity. That’s why, when you apply with us we always try to get you an answer the same day. As long as your business meets our eligibility criteria and can demonstrate a healthy cash flow in accordance with our approval criteria, we make you an offer. Then, once you have accepted the offer we may even be able to get your business the funding in 24 hours.

Choosing the best small business loan can depend on many factors – like how quickly your business need the funds, what you need the funds for, how much you need, how long you want to borrow the money for and the nature of your business. It may also depend on which business lenders you talk to. At Prospa, you can apply for a small business loan up to $300,000 over terms of up to 36 months. Our small business loans specialists are available to have a chat with you to help you determine the best small business loans solution for your business – so why not call the team on 1300 882 867 today.

The process of getting a small business loan with Prospa is straightforward and funding is even possible in 24 hours in many cases. If you’re an Australian Citizen (or permanent resident) over the age of 18 years, you have a valid ABN and can demonstrate trading of 6 months (for a new business) or 3 months (if you have purchased an existing business) why not apply today? You just need your driver licence, ABN and bank details to get started. Depending on how much you are applying for, you may also need some basic financial statements, like a P&L and cash flow.

Some businesses choose finance options like equipment finance, a credit card, a business line of credit or business overdraft when they need to pay for business expenses. However, a small business loan can be one of the simplest ways to get money to cover cash flow or for growth, opportunities or business expansion. With a small business loan the funds are paid back in regular instalments (with Prospa, it’s daily or weekly to work with business cash flow) over a fixed term (36 months to 3 months). Small business loans are a handy way for eligible businesses to get the funds up front to take on a growth opportunity or even to provide working capital to keep the business running smoothly. Interest rates vary depending on many factors, so you should speak to the business lender to find out more.

Other questions?